janein2394@gmail.com

Main page

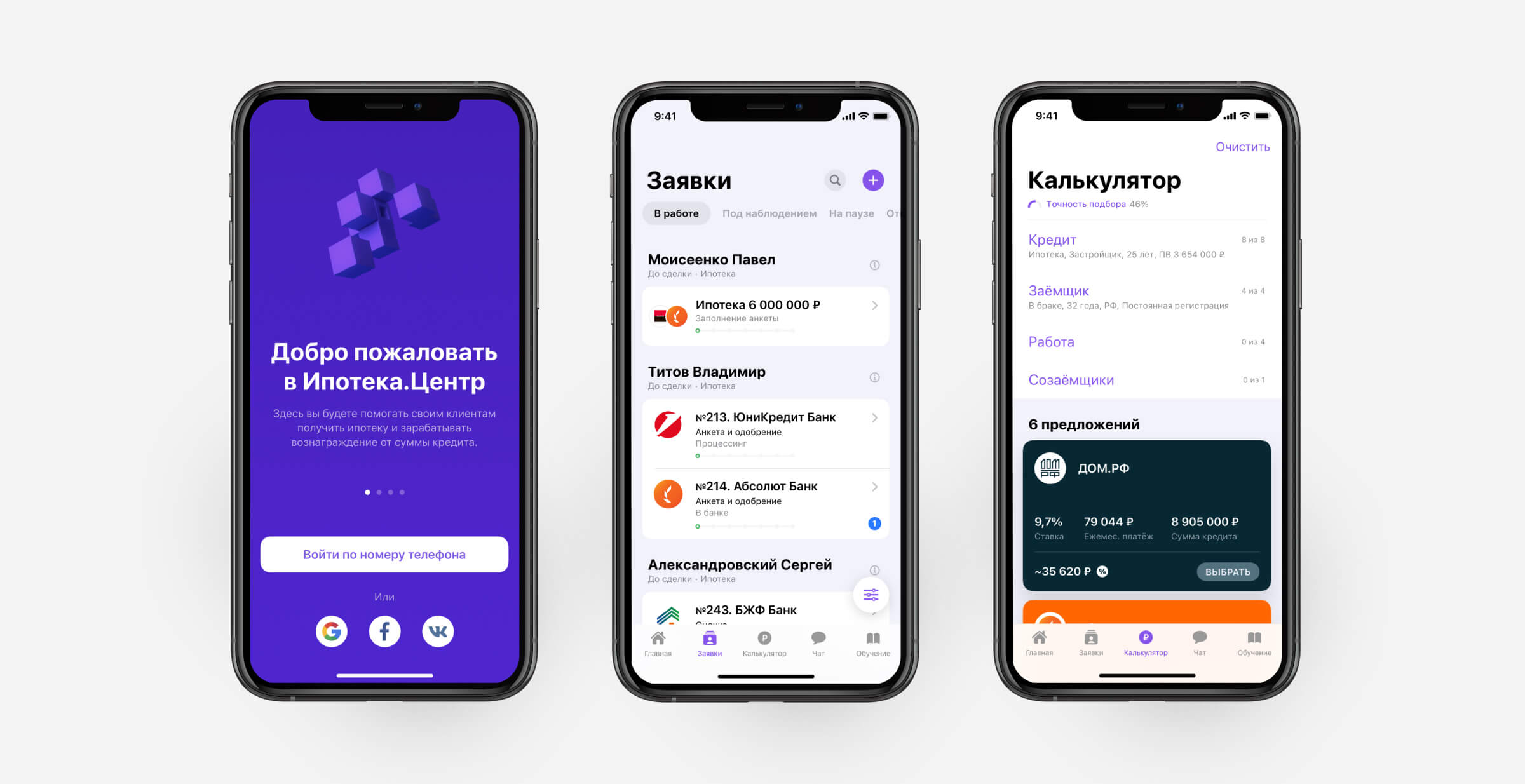

Ipoteka.Center

A platform for mortgage professionals. Here they help their clients get a mortgage in partner banks and earn up to 1% of the loan amount.

Overview

Ipoteka.Center brings together mortgage brokers with borrowers, banks, insurance and appraisal companies, so they no longer need to remember all the conditions and requirements of banks, work in several systems, keep records of customers and finances in notebooks. Now they can devote all this time to their clients.

To create a design of a platform we’ve been interviewing mortgage managers and literally sitting behind their backs watching their workflow. As a result, we’ve collected enough information to move further and create MVP-version of a product.

As a member of the design team, I worked on the MVP of the product and tried to imagine what the service should look like in a few years. I’ve conducted user interviews, collected feedback, held usability testings, worked on improvement and widening platform functionality. Most of the work was done for the web, and in 2020 we’ve begun designing iOS app.

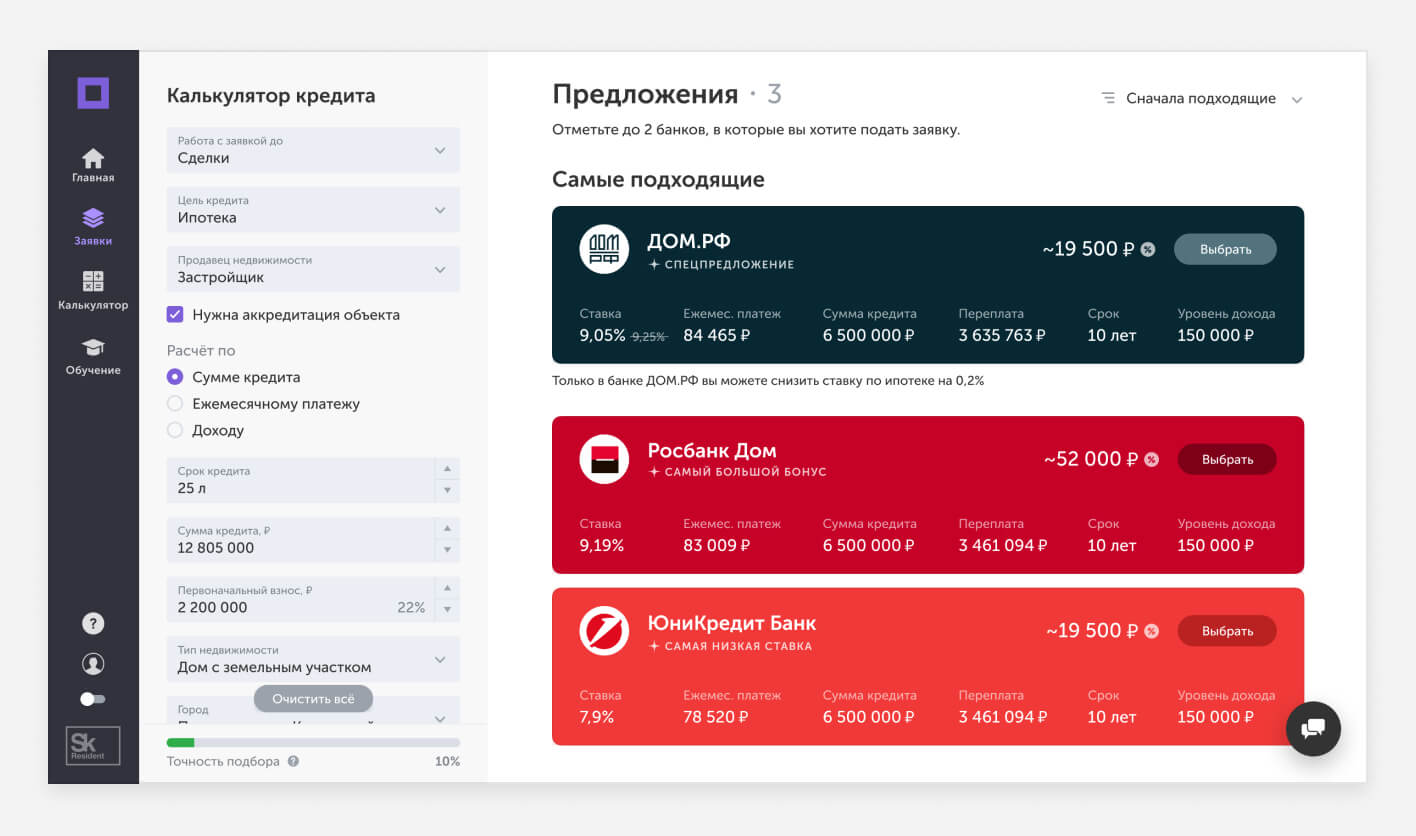

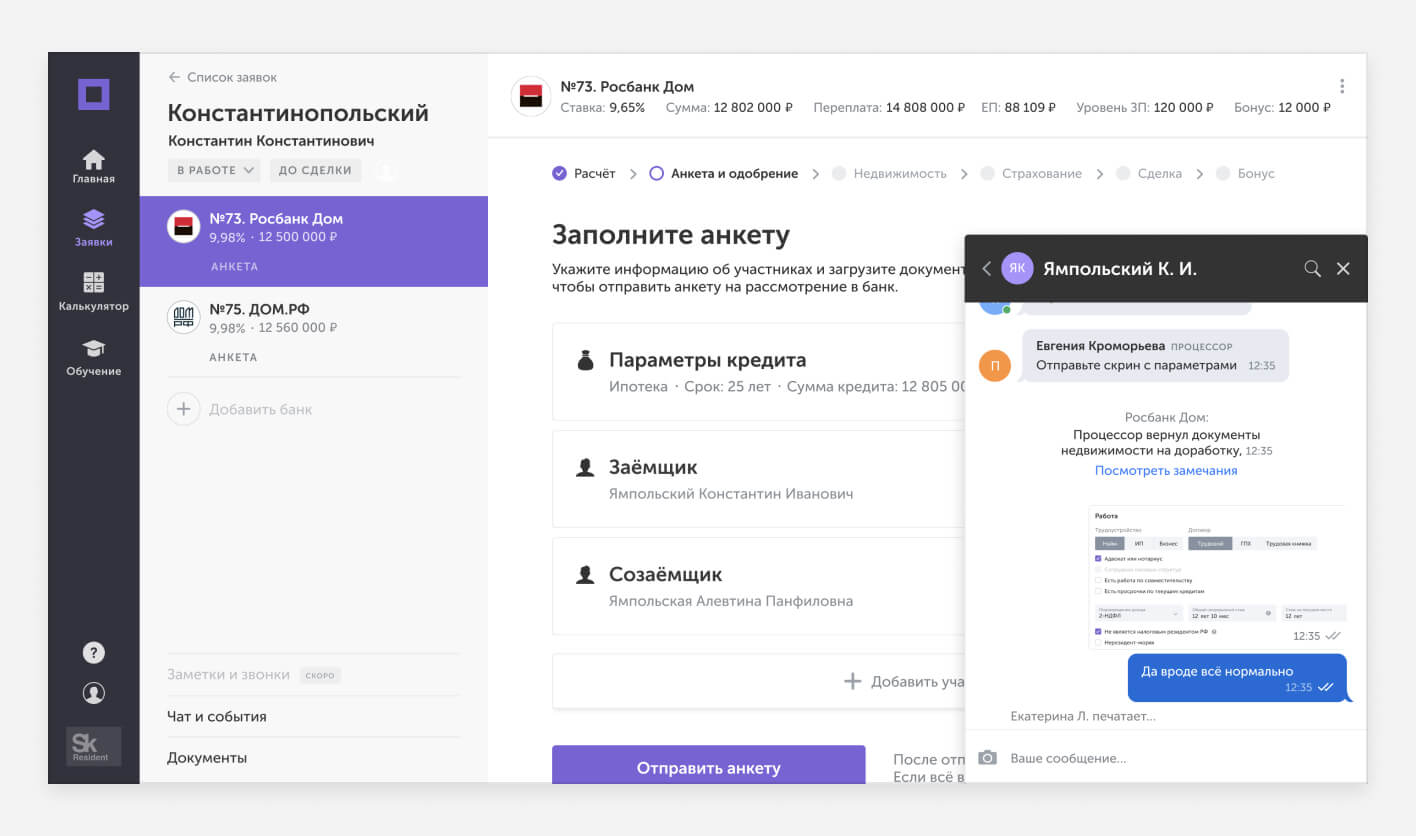

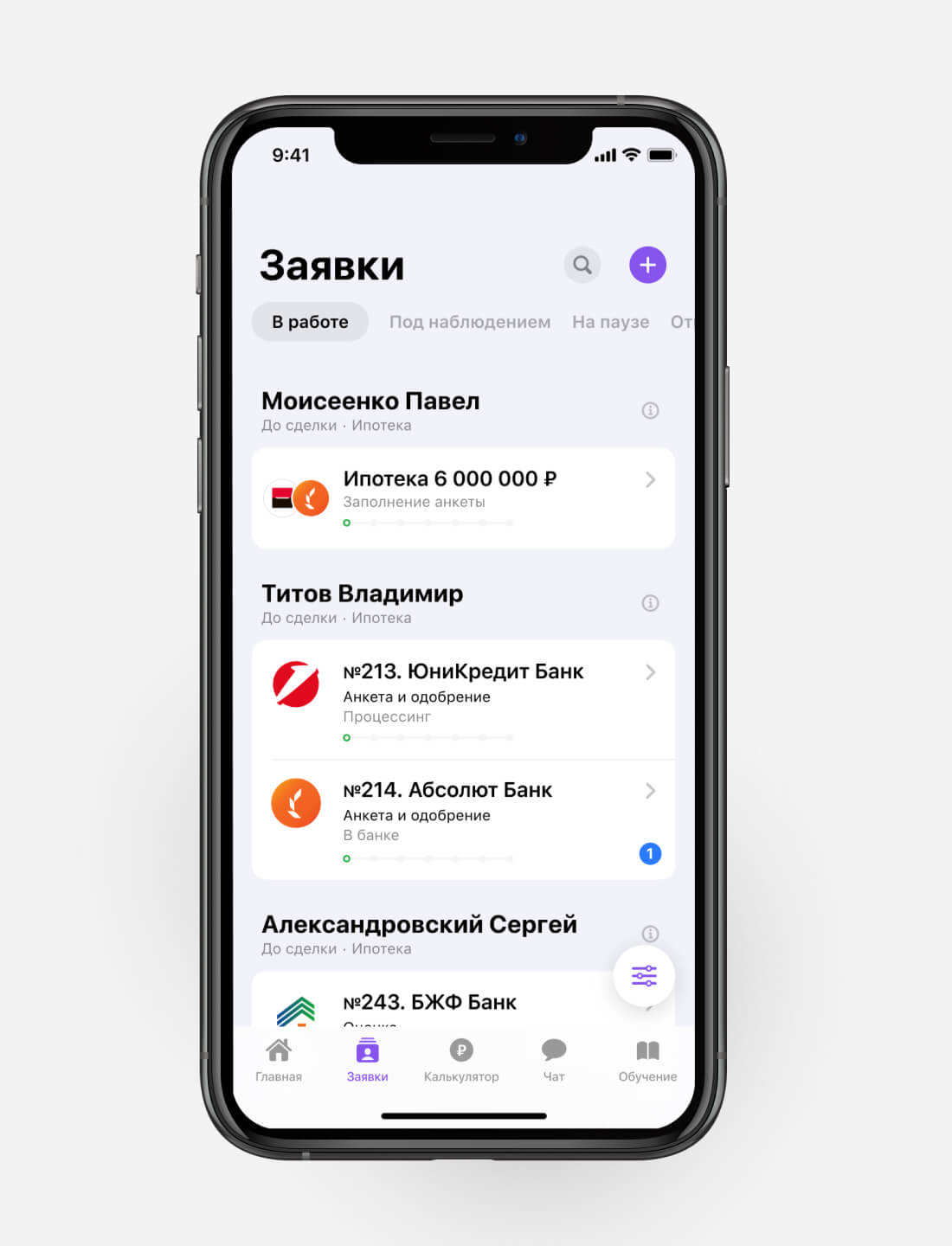

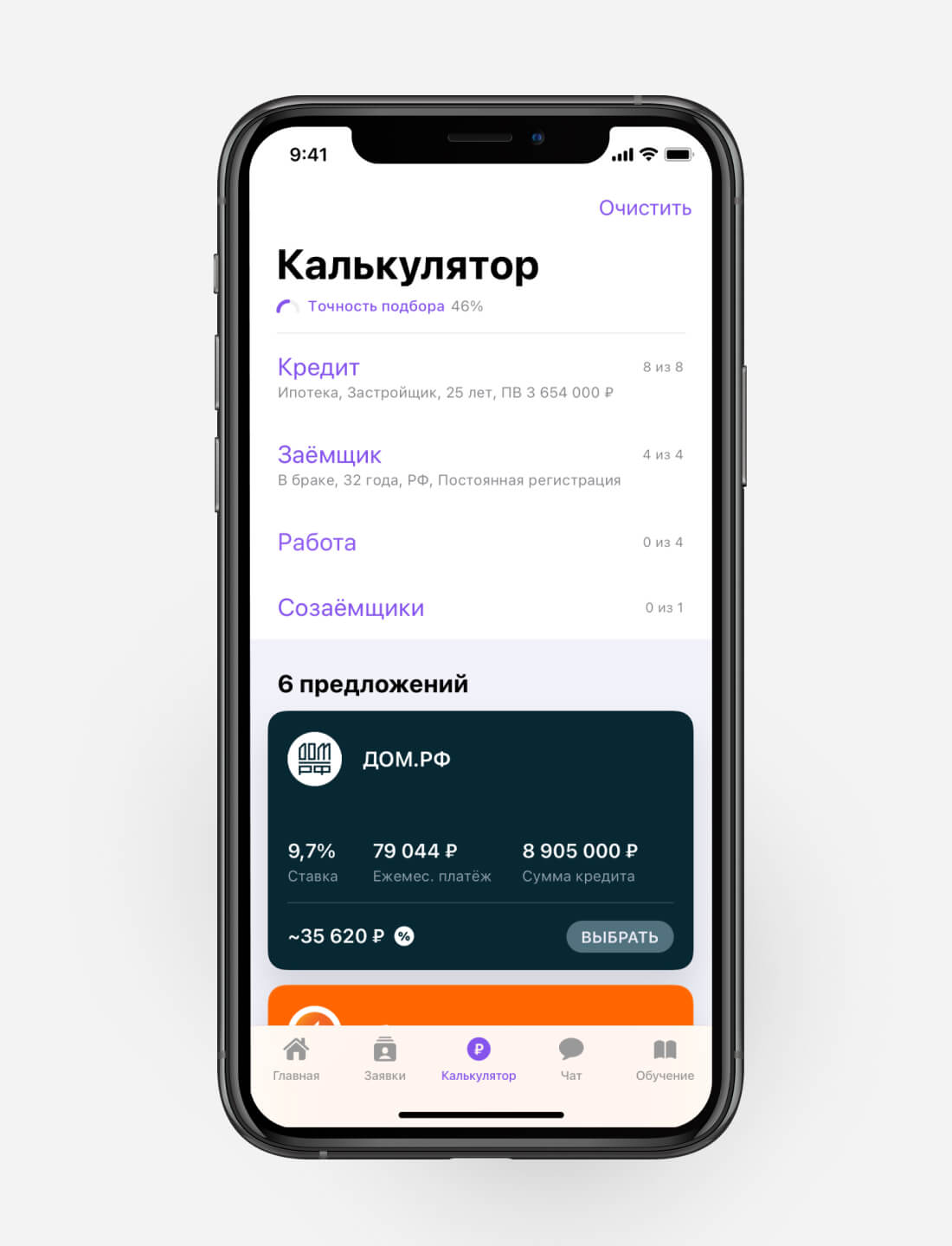

Personal account

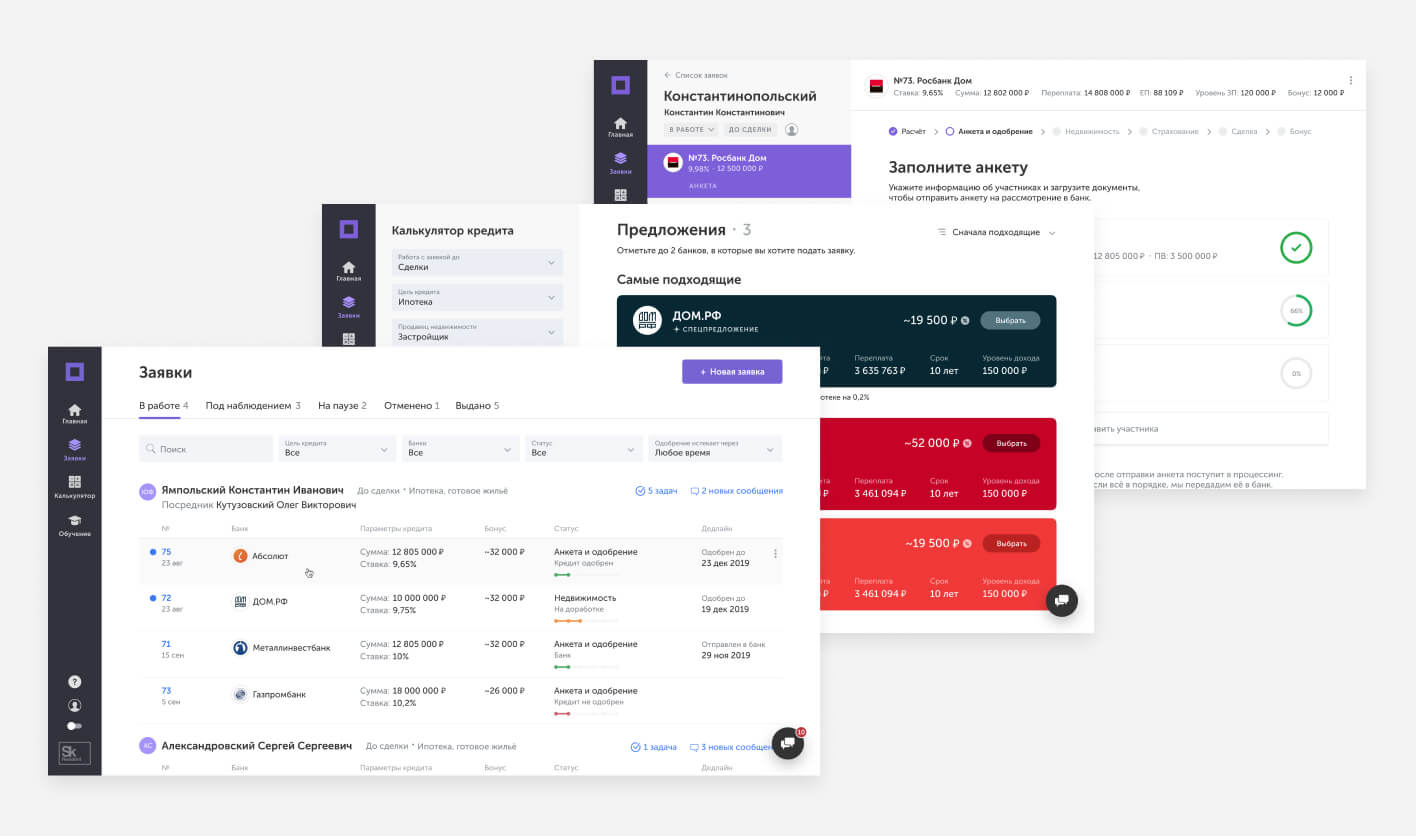

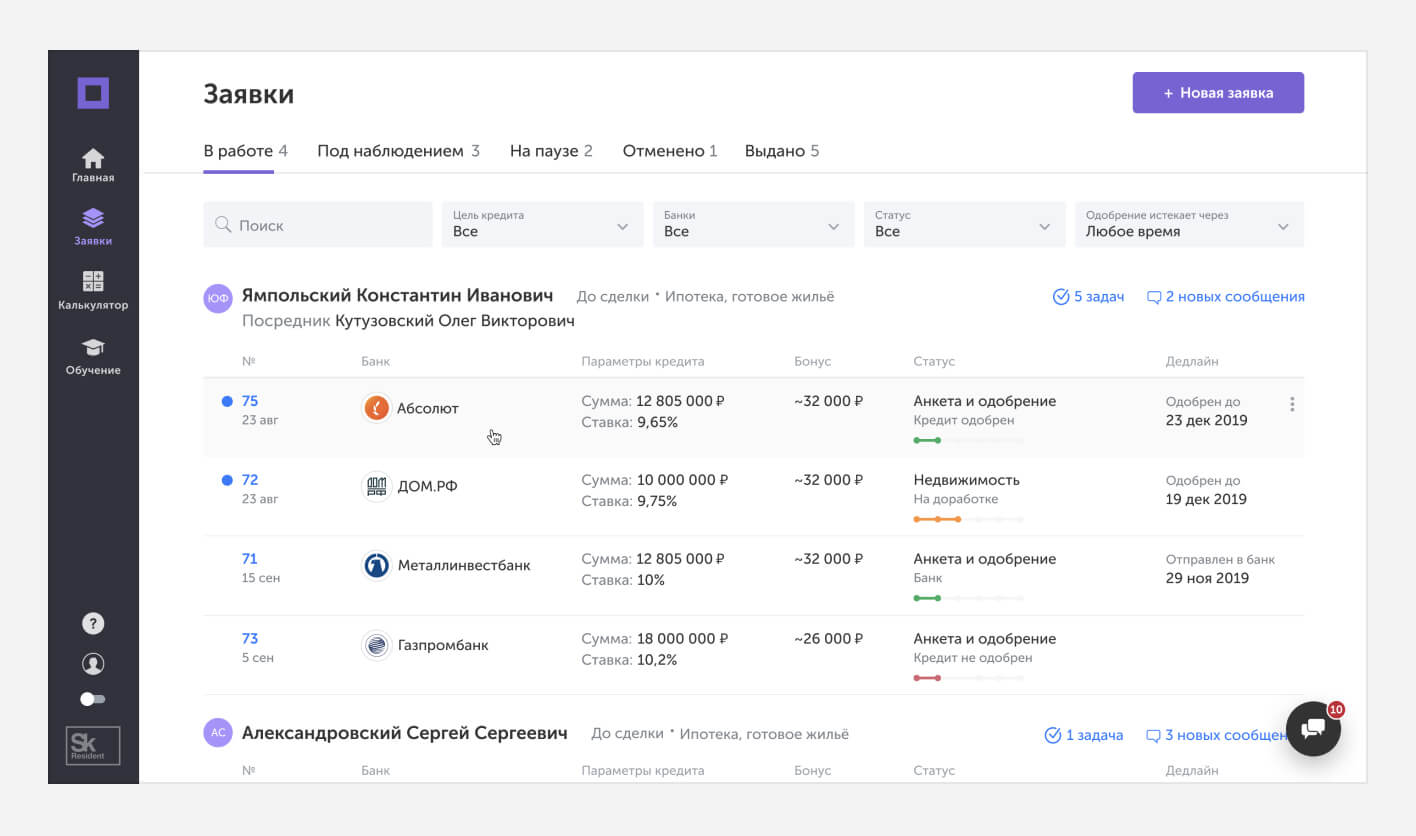

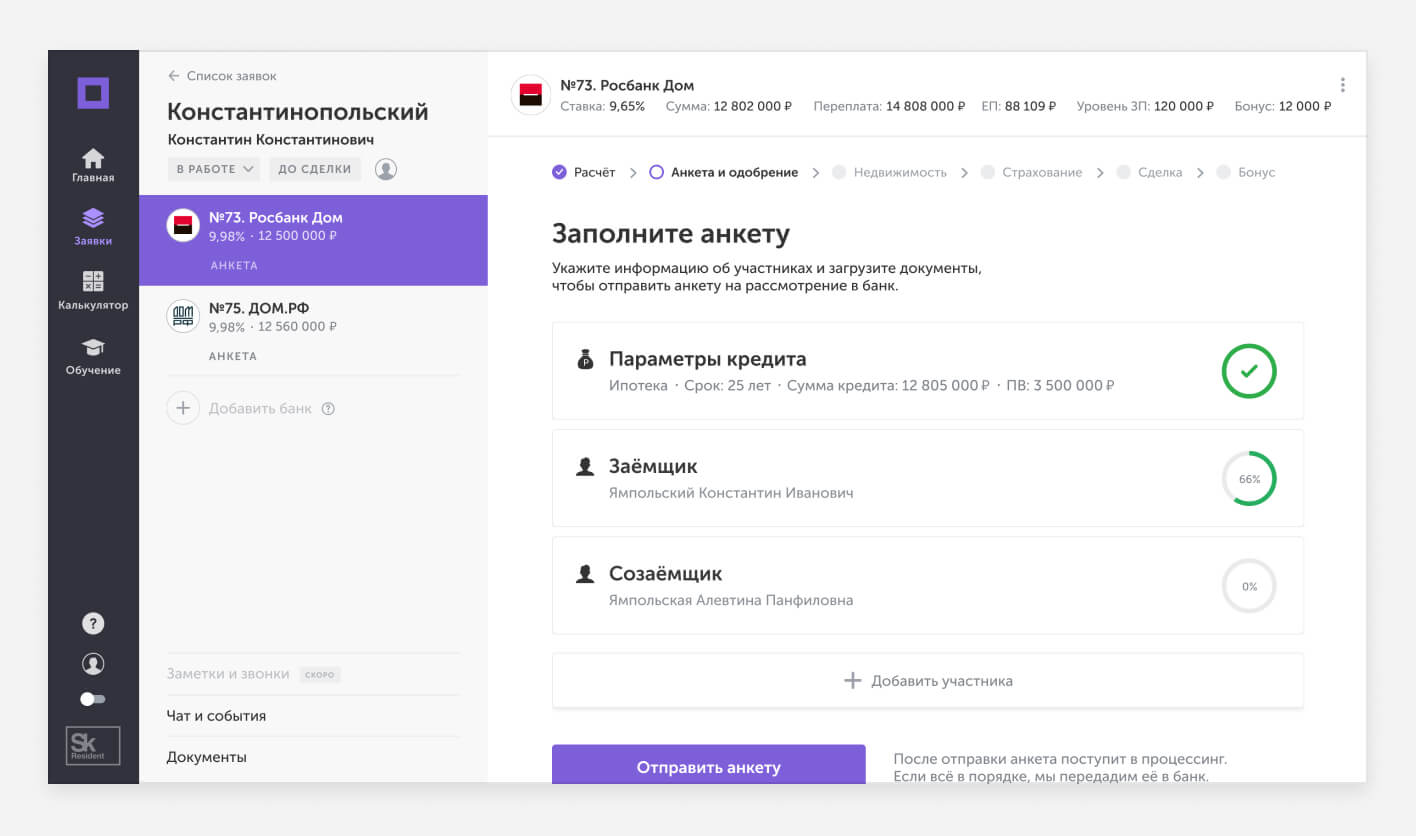

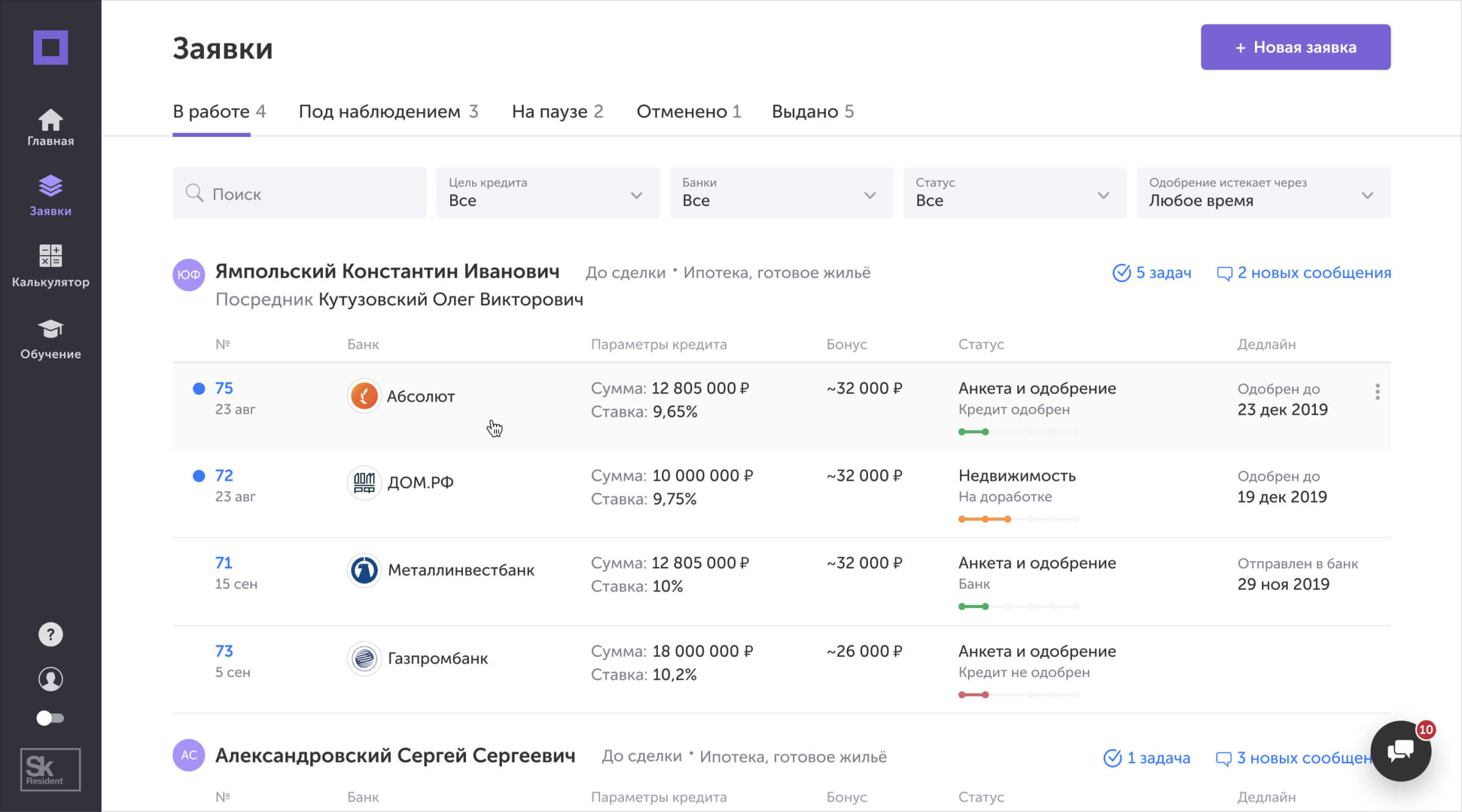

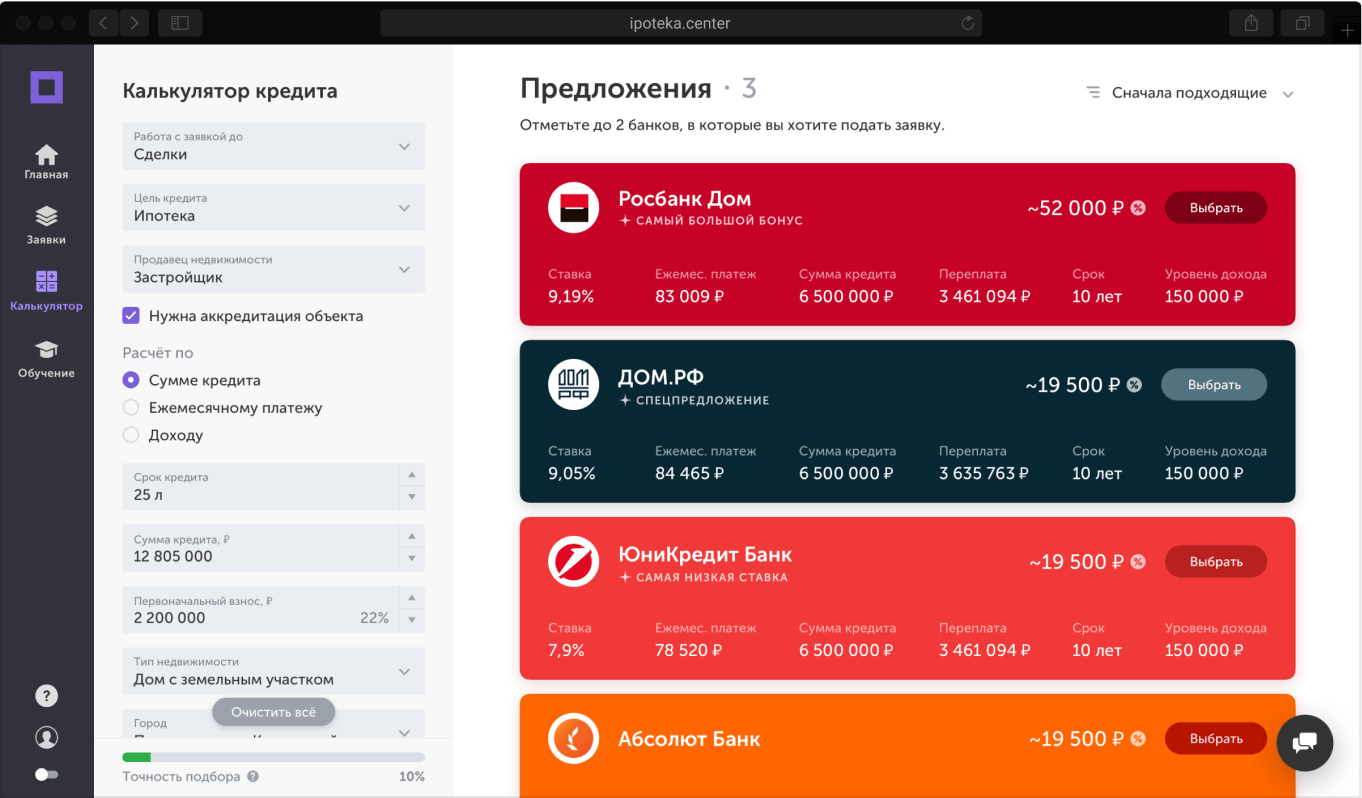

A key part of Ipoteka.Center was mortgage brokers’ (we call them business partners) personal account where they calculate the loan conditions for their clients, create requests and send them to the banks, get notifications on changing status of the deal and close successful deals.

Partner’s personal account screens: deals, credit calculator, deal page

And that’s not it

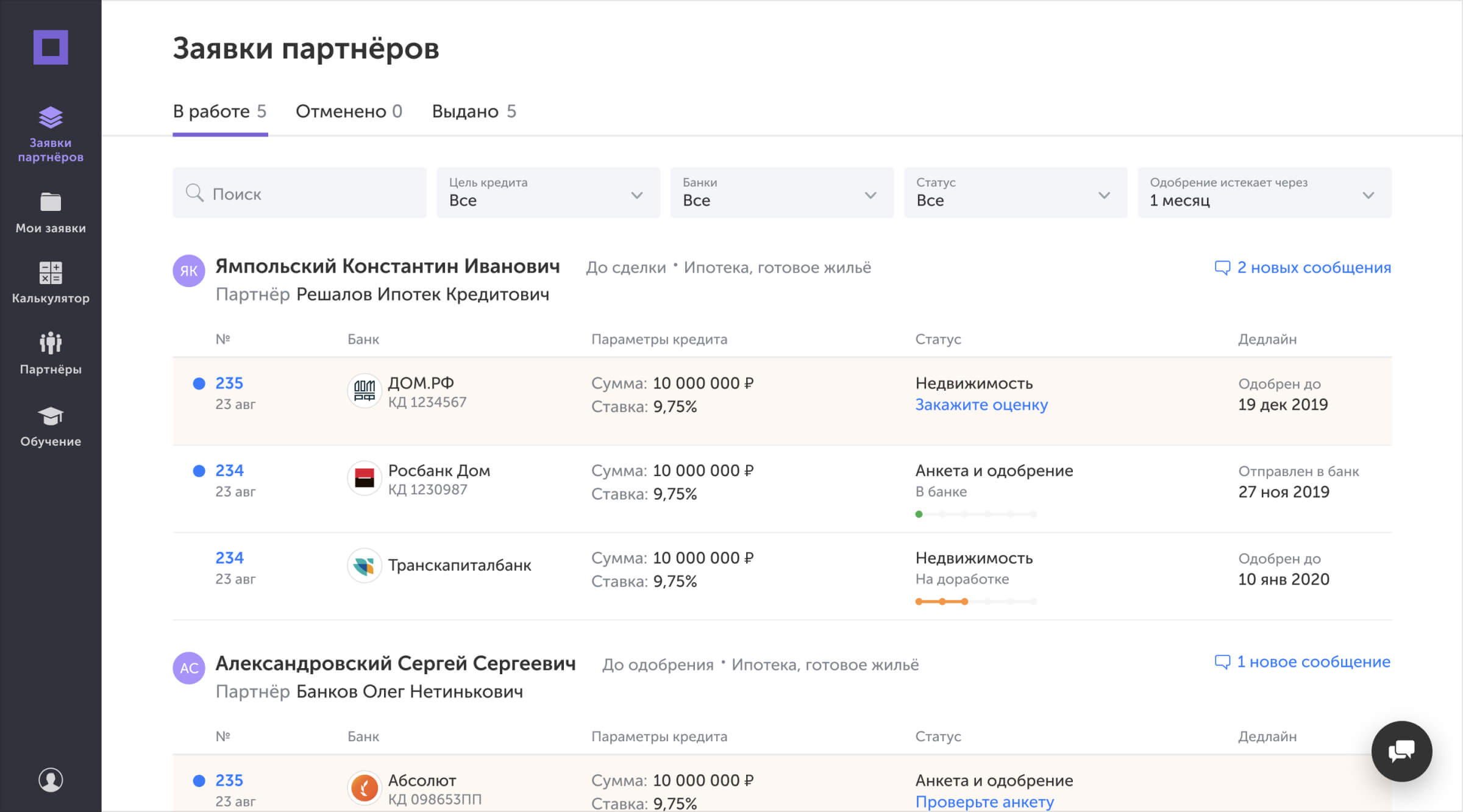

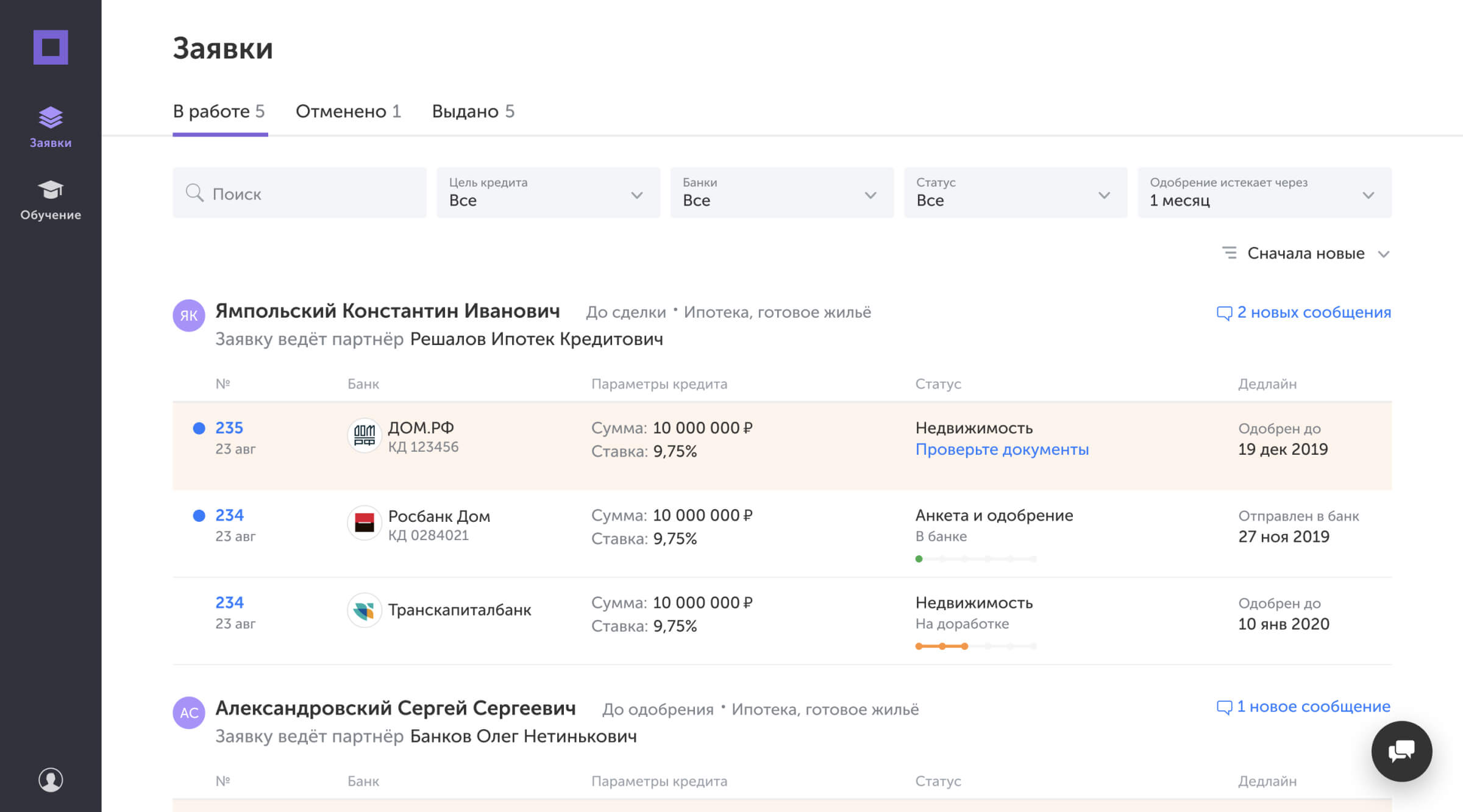

The platform doesn’t end with partner’s personal account. We’ve also created systems for curators and processors. Curators control the deal progress, answer their partners’ questions and help to appoint date deal in a bank. Processors submit applications to the banks and hold main communication with them.

Deals list partner, curator, processor

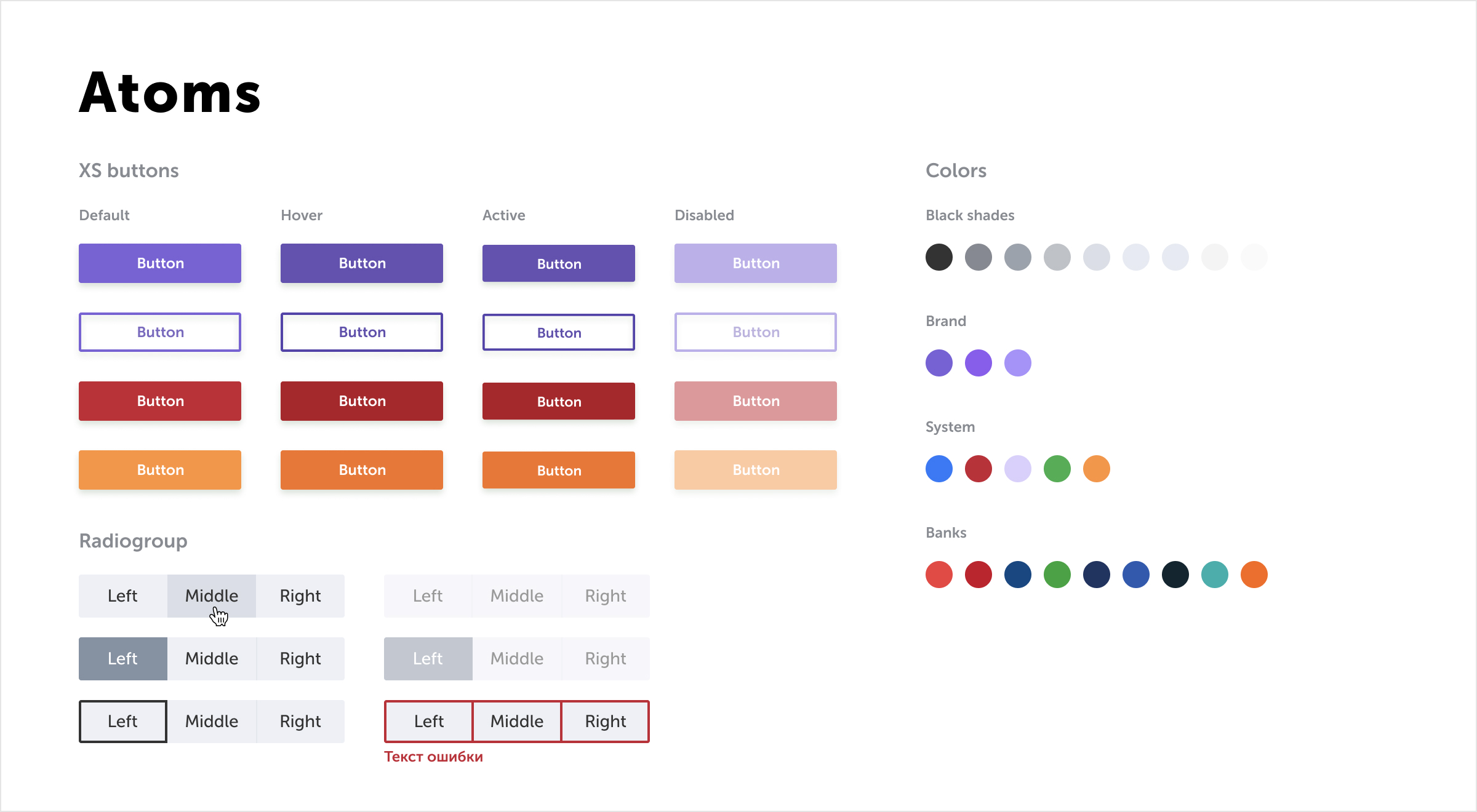

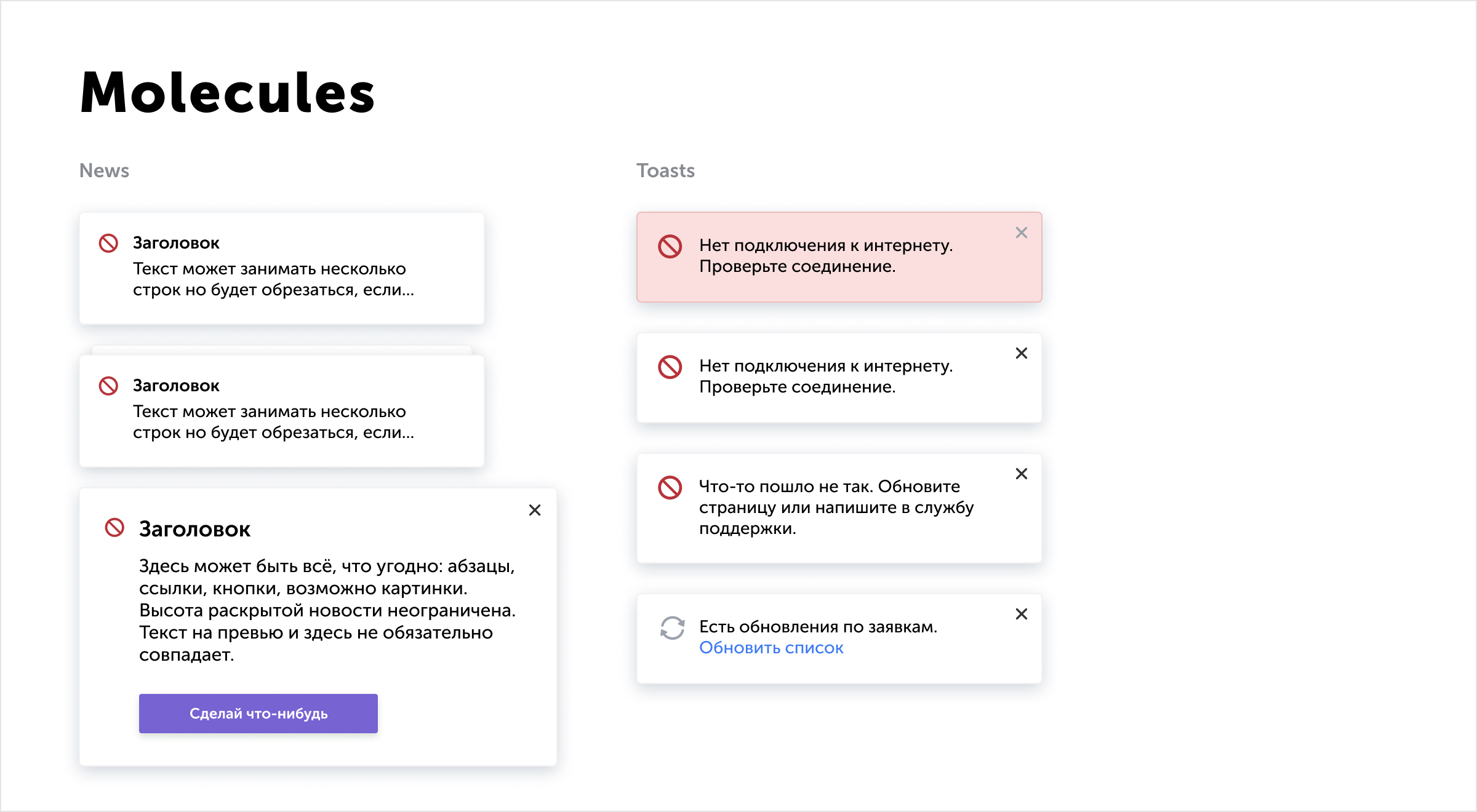

Design system

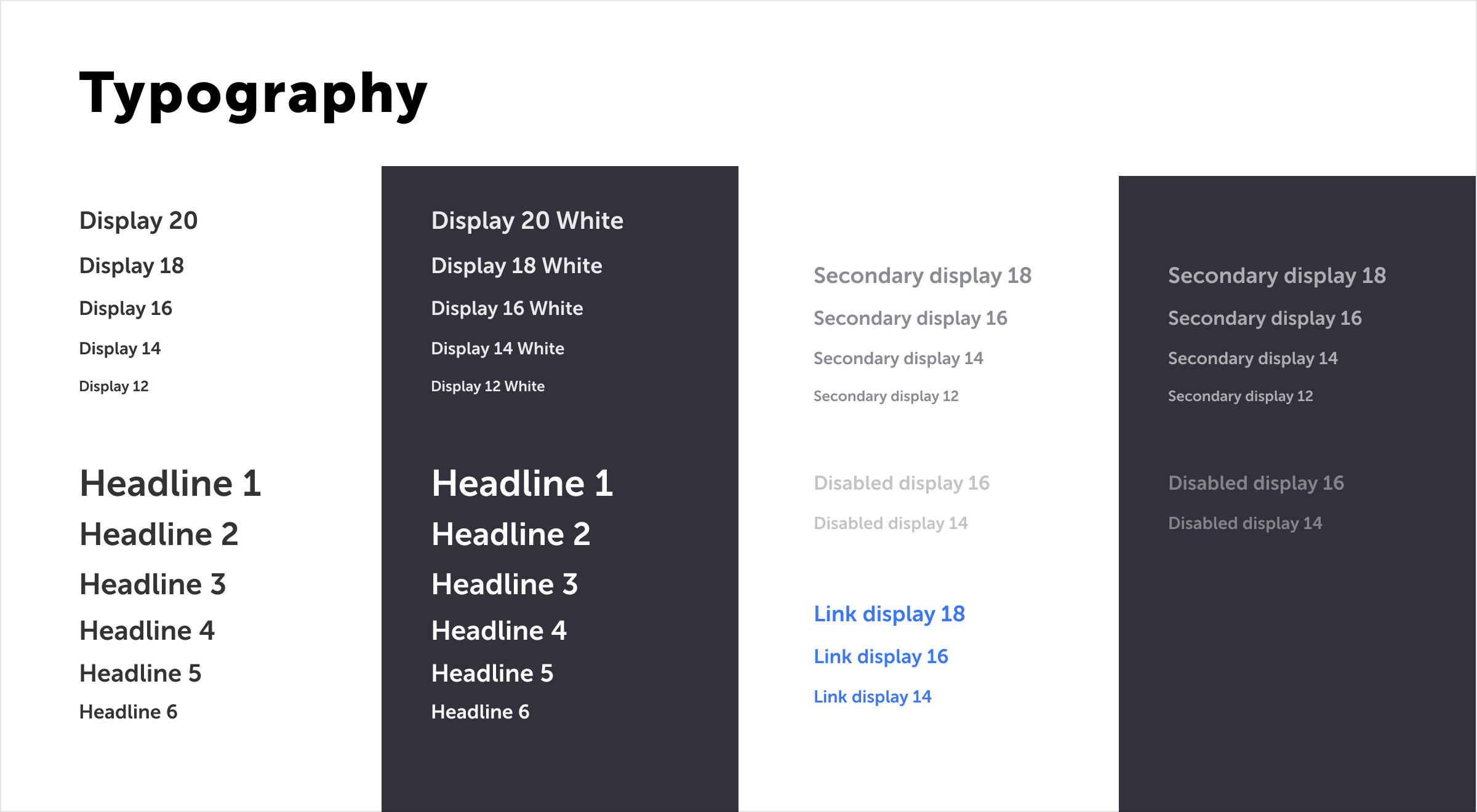

When platform functionality began to grow faster, and the number of sketch-files and mini-libraries after it, it became crucial to systemize all components to improve product consistency.

In cooperation with the development team, we’ve decided to create our own design system in order to build high-quality solutions faster.

We took as a basis atomic design system and systematized everything from colours & typography to buttons, forms, inputs, bank and deal participants cards.

As a result, we’ve updated old components, made them look more consistently and freshened up the look & feel of the entire product.

Communication

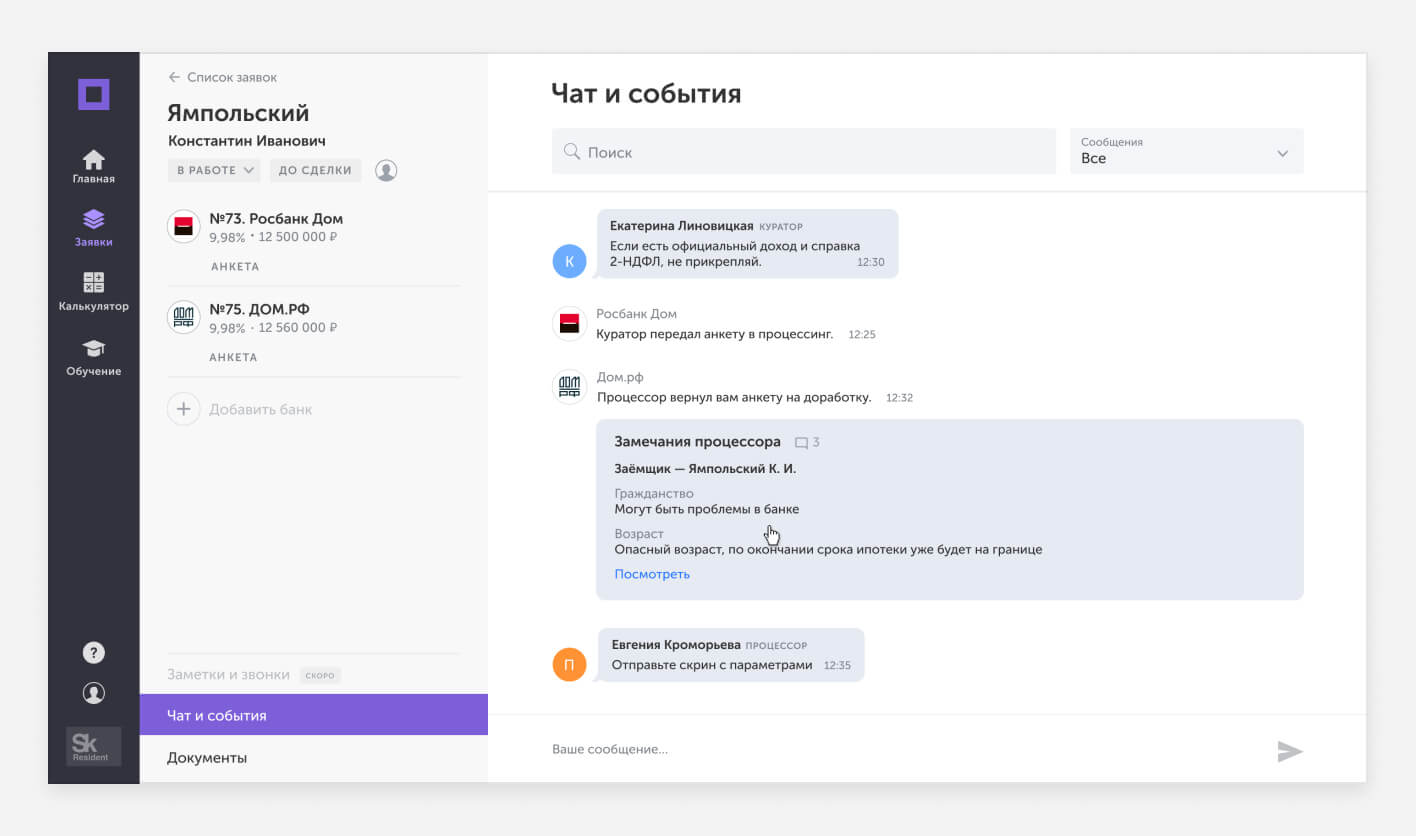

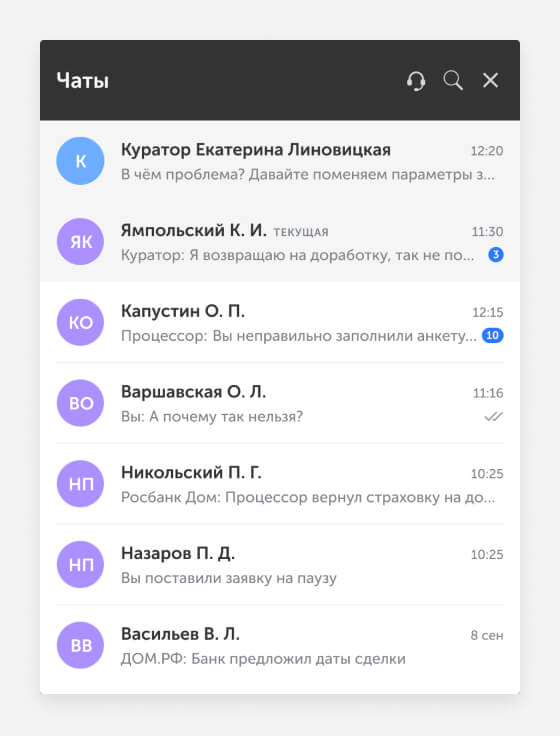

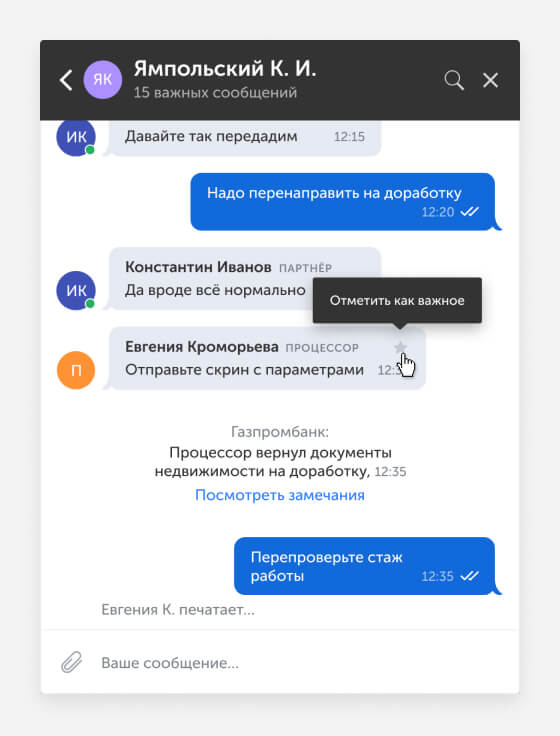

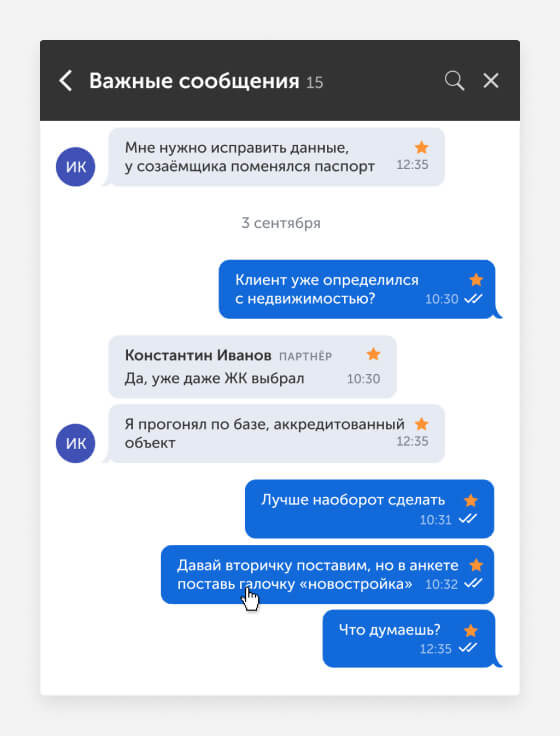

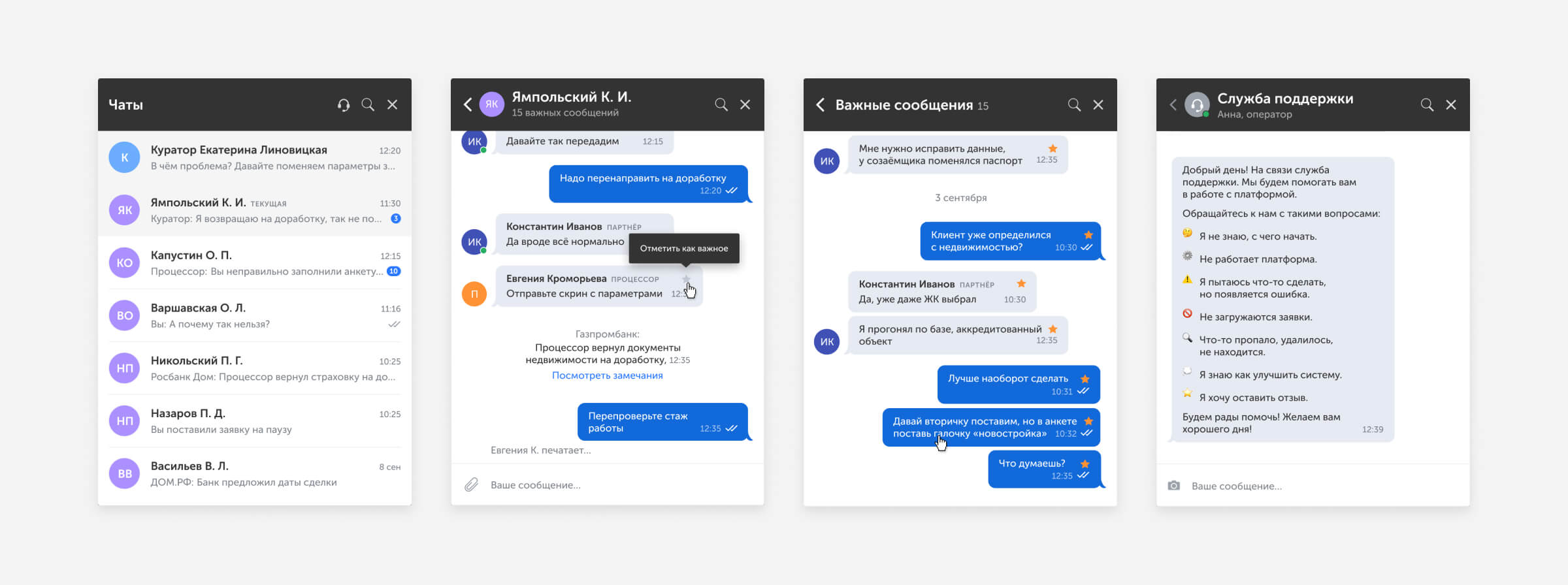

On the MVP of the platform, business partners, curators and processors communicated outside the platform. Important information wasn’t searchable, you can’t find sources, documents important dates which somebody sends via Telegram (or maybe an email? or WatsApp?).

Partner’s chat

Solution

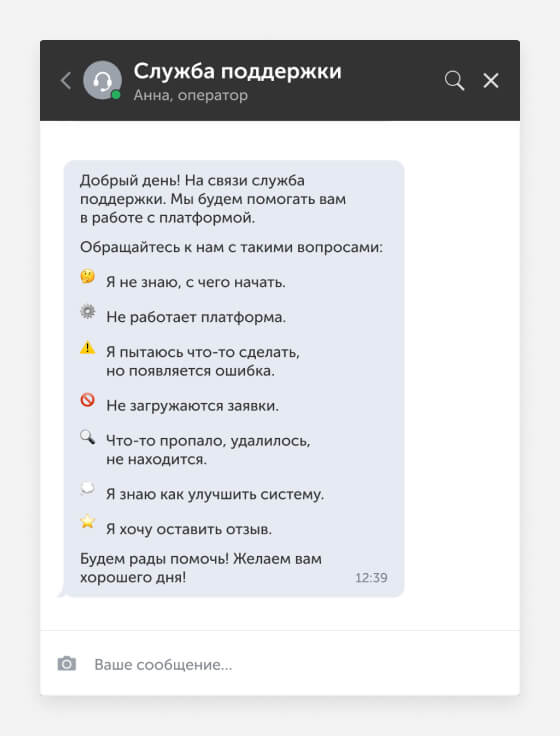

To clean it up and give our users one place to communicate, we’ve decided to add a chat on a platform. At the beginning we’ve planned to set an out of the box solution, so we’ve explored multiple chats, but none of them matched our requests.

As a result, we’ve decided to create our own chat where our users can chat, send files, learn about status changes, follow a deal story and look through archived comments and returns.

Chat sample screens

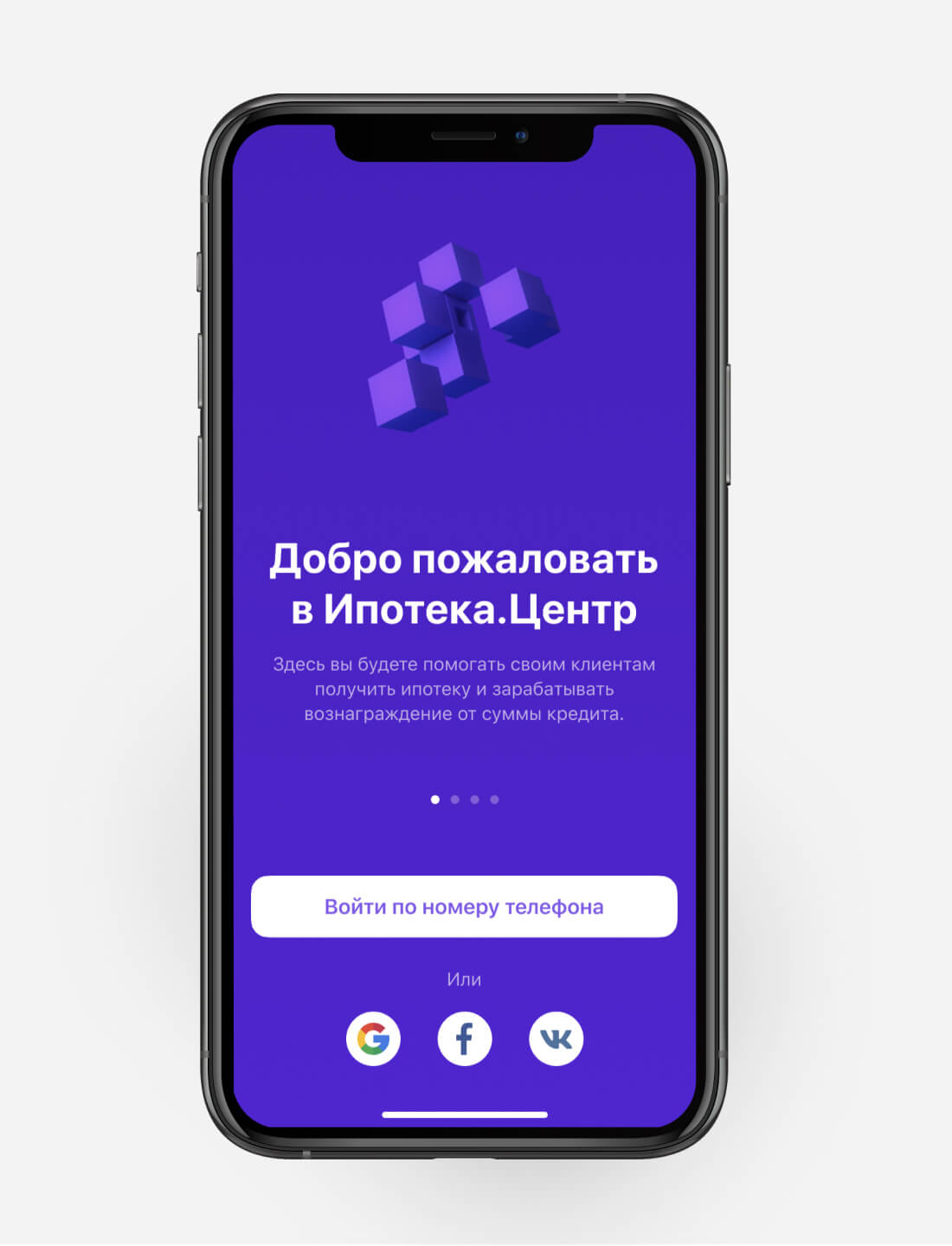

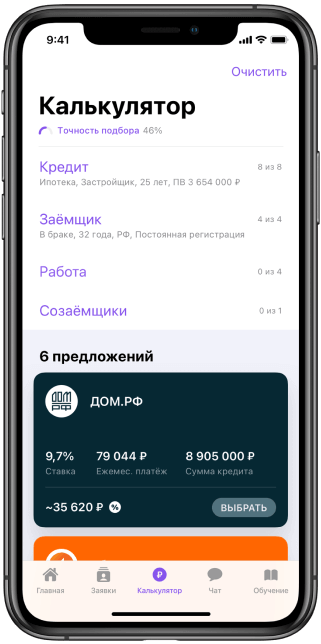

iOS app

Since we’ve launched the platform, partners were asking us to create a mobile version of it or an app, because the doesn’t always have an access to a computer, and our platform was developed without responsive version.

So we’ve begun to create a design and develop an iOS app. We’ve chosen functionality for the first release and Beta version and began working. The development is continuing.

Outcomes

Me and my team did a lot of product and analytical work. I’ve communicated a lot with the development team, analysts and managers, and users themselves. As a result, we’ve reinvented the mortgage world for brokers and their clients and created a platform that is being used by more than 3k mortgage experts a year after launch.